The following post was sponsored by AxiomGo

How many Americans stick to a budget? According to a recent survey, a whopping 82% claim they do. When pressed to define exactly how they do it, 33% said it’s “scrawled out on paper somewhere” and almost 20% keep track “in my head.” (Obviously, that’s not the most efficient way!)

Budgeting can be complicated and confusing; the truth is that almost 60% of Americans don’t use a household budget, even though it’s essential for buying the things you need (and want) now, along with saving for the future.

Here are seven practical tips that will make it easier to stay on track financially:

1. Keep it real

Starting a budget is like starting an exercise routine: It’s best to ease yourself into it. Drastic changes that are impossible to make will only leave you feeling discouraged and defeated. Don’t beat yourself up when you stumble. Learn from your mistakes and keep at it.

2. Don’t guess

Review all your bank transactions for the past three months to get an idea of how much your life really costs. Don’t assume you spend only $50.00 a month on gas. Find out what you’ve paid in the past and budget that amount. You’ll be surprised, maybe even shocked, by what you discover.

3. Use the right tools

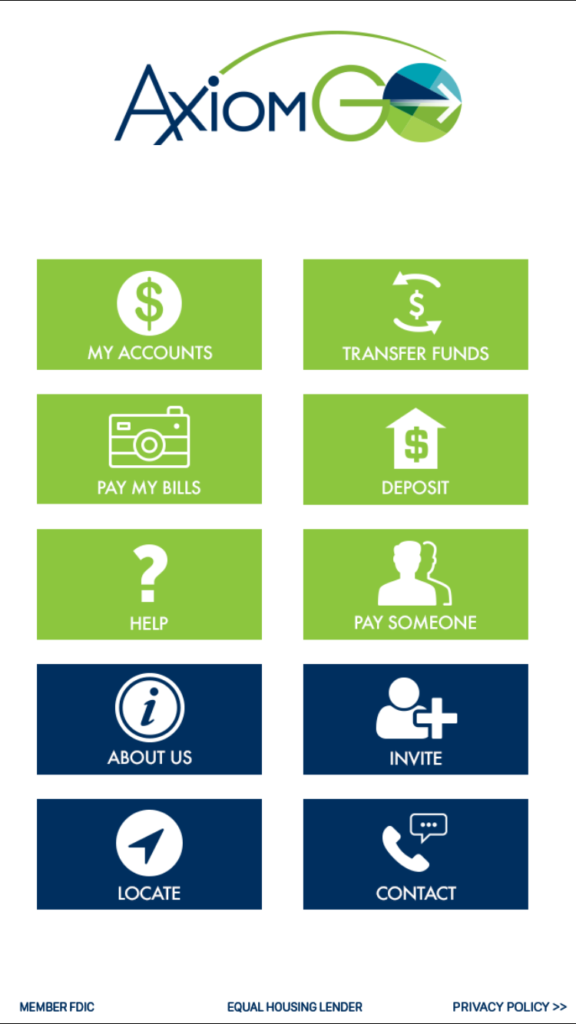

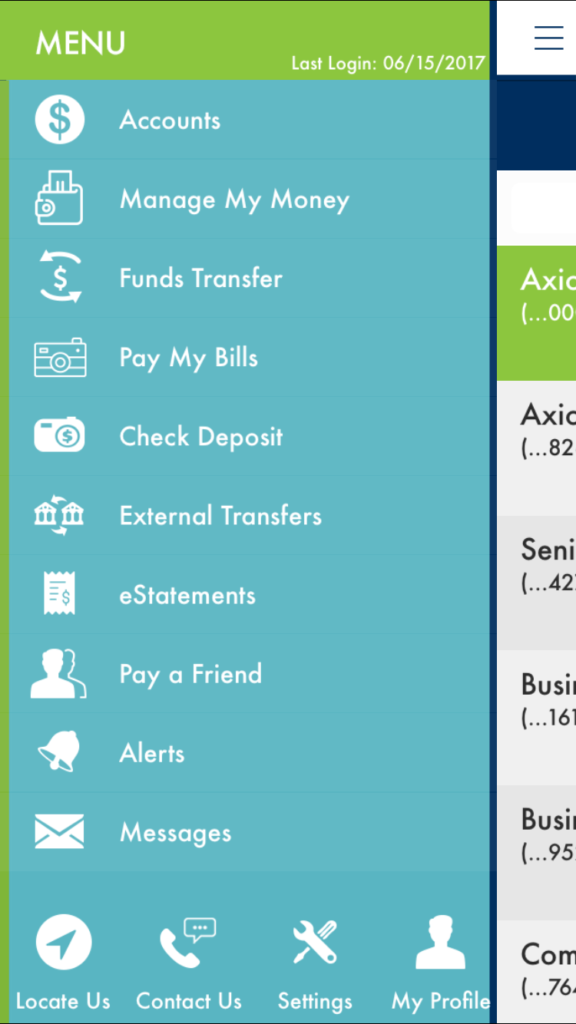

Axiom Bank’s new mobile app, AxiomGO, has an integrated personal budgeting tool, My $ Manager, that calculates your income and helps you set spending limits for various categories. You will get pinged when you’ve almost reached the amount allotted for each category, meaning you’ll know to start saying “no” so you can still cover the mortgage. Furthermore, you’ll be able to set payoff and savings goals to keep yourself accountable.

4. Be a money detective

Identify a common purchase or two that can be cut back or eliminated. For example: One less trip to the coffee shop each week could net you $300 over the course of a year. One fewer family dinner at a restaurant each month could easily double or triple that. Build upon your early success by tackling one expense at a time.

5. Challenge yourself

Vow to stop eating lunch out and then transfer what you would have spent to your savings account. Try a spending freeze where for a week or two you only buy necessities. Plan “no-spend” weekends and fill them with free entertainment alternatives. Get friends and family in on the action by challenging them to a saving competition.

6. Budget to zero

One way to do this is to record in detail every single purchase you make for a week. When mapping out your expenses, account for every dollar. It may feel strange or uncomfortable to do this, but it’s important. Only when you know how all your money is being spent will you actually become in control of it. Plus, you won’t be left wondering “where did it all go?”

7. Focus on the endgame

Forgoing certain purchases might feel like a sacrifice, but keep it in perspective: You’re on the path to something bigger. Whether you want to retire early, eliminate debt, save for a vacation, boost your rainy-day fund or simply stay in the black each pay cycle, focus on how small savings decisions can really add up.

Log into My $ Manager on the AxiomGO mobile banking app and start setting your financial goals. By doing so, you could score big time. Just one goal will enter you to win one of two $250 prizes, or one of three $100 prizes!