The following post was sponsored by Axiom Bank.

Ah, spring—the time we all feel the urge to declutter and deep clean. In addition to making the house pristine, there might be another part of your life that could use a good sprucing up—your finances.

Ron Strand-Sorrell, EVP Chief Operating Officer, at Florida-based Axiom Bank explains why that’s so important and how to go about doing it. “Your income and spending can change over the course of a year, sometimes drastically. We usually take notice of the big changes, but all those little changes can add up and have a significant effect on your overall financial health.”

Follow these eight expert tips on how to spring clean your finances, and you’ll be well on your way to getting your finances in order:

1. Review your budget

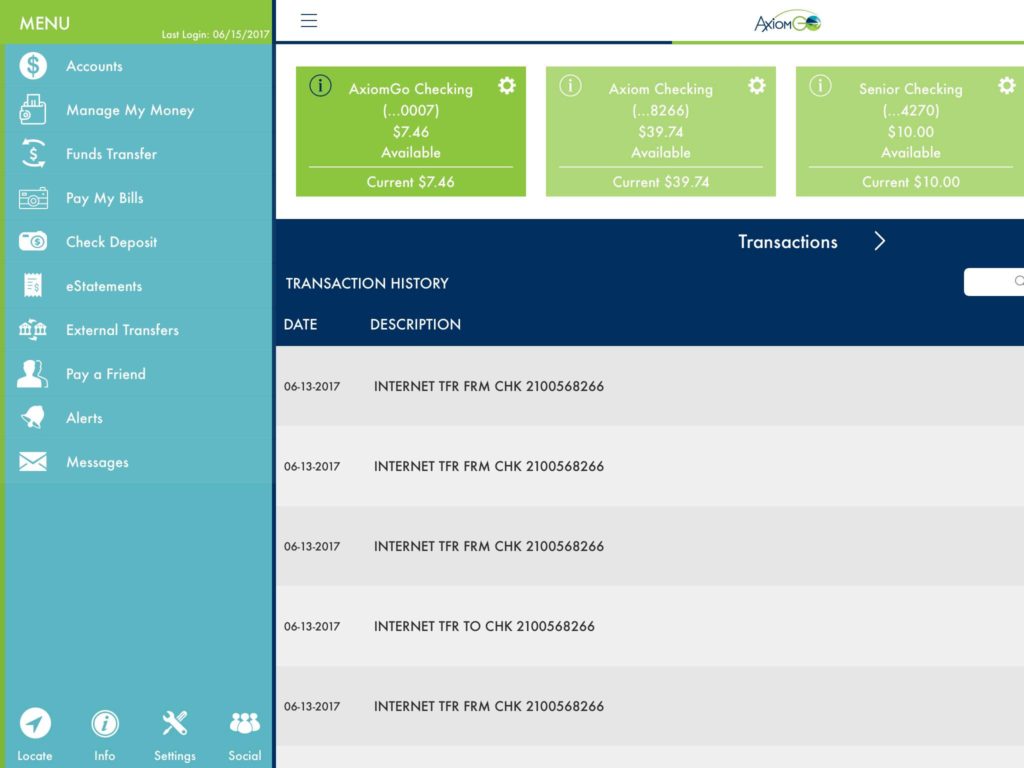

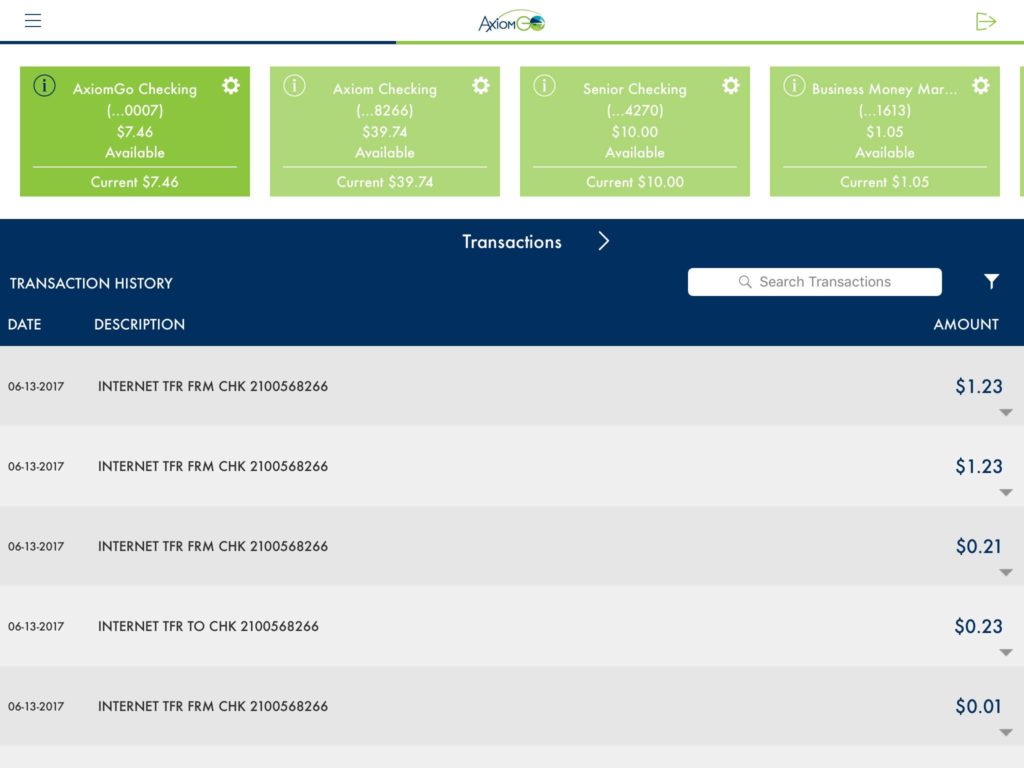

When was the last time you looked at your budget? A lot may have changed since then. Now is the time to revisit your income/expenses and adjust them as needed. Try a new tech tool such as the AxiomGO mobile banking app that offers a budgeting tool, My $ Manager, to set savings goals and spending limits for various categories. The app notifies you when you’ve almost reached your limit, which is so helpful.

2. Organize your financial documents

Where do you store your bank statements and tax documents? Take a few hours to develop an organization system, whether that’s arranging documents in a plastic storage bin or creating PDFs to store on the cloud. Here’s a look at what you need to keep and what you can toss.

3. Go paperless

Save trees and cut the clutter by opting out of receiving monthly paper statements for your accounts. Less paper = less junk! Worried you’ll forget to pay your bill? Try #4.

4. Set up auto pay

Never miss a payment. Never pay a late fee. Just be sure the money will be in your account on the dates you’ve scheduled to avoid any overdrafts.

5. Scrutinize your credit report

You are entitled to a free copy of your credit report from each of the three credit reporting agencies every year. Look for things like old accounts you’ve forgotten to close or multiple reports of the same debt. Check for errors, too, such as information for someone with a similar name appearing on your report. Errors are actually quite common! Get a free copy here.

6. Evaluate your debt

How much do you owe? What are your interest rates? Set up a plan for paying it all off, prioritizing accounts with the highest interest rates. Be bold: Give your credit holders a call and ask for a lower interest rate. They’ve been known to do it. Or, consider transferring credit card balances to a no or low-interest rate card.

7. Examine your insurance

Are you getting the best deals on home, life and auto insurance? Have your coverage needs changed? Take a visual inventory of your belongings. Photograph all of them and record approximately how much you paid for them. Should disaster strike, such as a fire, this will be invaluable!

8. Find and eliminate hidden charges

Check your phone, internet and cable bills to see if you’re paying for services or features you don’t use. If you are, have them turned off. If you’re not using your gym membership, cancel it. And make sure you’re not being charged for expired “free trials” that aren’t useful, either. Little charges add up and eliminating what’s unnecessary can be very productive.

Axiom Bank, N.A, a nationally chartered community bank headquartered in Central Florida, provides retail banking services, including checking, savings, money market and CD accounts, as well as commercial banking, treasury management services and commercial loans for both real estate and business purposes.

I signed up for the app last month. It works well for me, especially the alerts.

Very glad to hear that. I really like it as well.

These are all such great ideas. My husband and I signed up for a monitoring service that watches not only our credit cards, but bank accounts and anything related to our names and social security numbers. The first report that I got back showed that someone else was using my social security number way back during the time I was just out of college! I’ve met with the SS office and got things cleared up. You just never know what you’ll find!

CINDY B

So true! I’ve heard the majority of people have errors on their credit reports. I check mine annually at least. Never can be too careful.