The excitement of buying a new home is incomparable; from touring that first property to closing the deal, it’s a wild rollercoaster ride. For most, it’s a symbol of adulthood and security. Everyone has to live somewhere, right? The only hard part is affording the dream. Such a large purchase can mean decades of debt, so it’s important to have a game plan.

If you’re ready to buy that new home, but don’t want to live house-poor, here are some ways to budget so you can have it all.

Research The Market

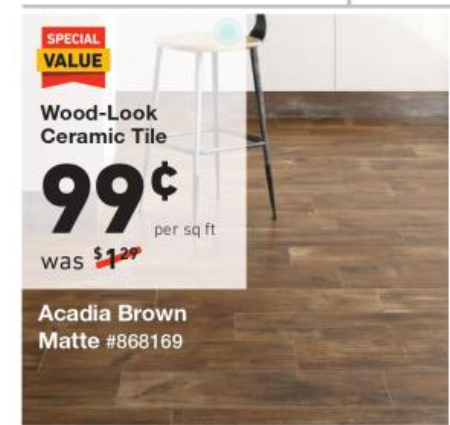

The most crucial part of budgeting for a home is to know what you can afford. Look at local listings and find the average. If you already own a home and will be swapping, remember that the cost of selling a house adds to your closing fees as well, which should get taken into consideration.

Once you’ve got a ballpark number in mind, start saving for the down payment. Typically, this price ranges between ten and fifty thousand dollars, which is more than most Americans have in their savings. Don’t expect to save it up overnight. It will take time! Little by little, month by month.

Save For More Than The Home

Your savings shouldn’t just be for your house purchase price, but also maintenance and repairs. Keep separate savings for emergencies, at least two thousand dollars, that you can put towards any unexpected expenses. You don’t want to buy your home, and then miss payments because you put your emergency funds into it.

Make Your Savings Untouchable

A lot of people have trouble keeping their savings safe. Instead of just tossing your money into an easily-reached savings account, there are other options. Bonds make sure that your money can’t be touched for some time, while also gaining interest on top of it. Make sure to only create safe, smart, slow return investments.

Be Honest About Your Finances

Don’t tell yourself that you’ll suddenly save six hundred dollars more a month than you have before. Drastic changes are difficult and very unlikely to stick long term. It’s okay to have fun and indulge, provided you’re setting aside a reasonable amount. Maybe instead of spending money on movie theatres every week, make a big event of streaming a movie in the den, with some yummy snacks and drinks. Remember that a budget allows for all your needs and wants, just not everything on the same day.

Your home is going to be the place where you feel safe and comfortable. This is a big decision. It requires planning and effort. Don’t rush into it. Buying a home should be a good experience, and when done on a budget, most of the stress can be eliminiated.